The market has been a little unstable since 2018, and the ups and downs have been intense.

In recent years, I think many people have been confused by a big fall in stock prices in December 2018.

I was temporarily hit by this fall, but I thought it was a good place to buy and went to buy.

It depends on the investor, but here’s a quick rundown of what I’ve done.

What’s important is to understand a crash and a shock.

Difference between crash and shock

Let’s take a quick look at the stocks you should buy when a crash occurs and the stocks you should not buy when a shock occurs. Understand the crash and crash First, understand the crash and crash of the stock market. These two seem similar and very different. As a matter of fact, a sharp drop in stock prices is common. I think a sudden plunge once a year is possible. The most recent example is the China crash and the crash at the end of 2018.

What is a crash?

The crash shows basically a V-shaped recovery. In other words, it falls quickly, but it has a characteristic that the stock price returns quickly even if it goes down.

As an investor, I’d like to see a rebound in stock prices. In some cases, leverage can be used to rebound.

You can think of a sharp decline as a consolidation of your stock position. In other words, the stock price that went up too much will go down to a reasonable level once it is liquidated.

What is the shock?

A shock occurs about once every 10 years.

The most recent one is the Lehman Shock. One of the characteristics of a crash is that stock prices sometimes run out by the year and it lasts for a long time.

In other words, stock prices tend to stay low for a long time, so you have to endure the winter.

Leveraging at the time of a crash can increase your debt and cause you to go out of the market, so I basically don’t recommend it.

How to distinguish a sharp fall from a sharp fall.

It is important to sense the atmosphere of the market and the economic situation.

When there is a shock, even major companies will collapse.

For example, Lehman Brothers collapsed and Yamaichi Securities also went bankrupt at the time of the past crash.

When relatively large companies continue to fail, there is a high possibility of a shock.

If you look at the current economy, you can see that as of May 2019, there is no situation such a shock.

So at the moment, there are no signs of this, and if it goes down, I will buy on the assumption that it will return. I

don’t think we need to be intimidated by a Lehman shock-sized crash.

In the case of a sharp fall, you buy stocks in the process of returning to the market.

What to buy?

Basically, you should buy mainly stocks whose prices are easy to return.

In some cases, I think it’s a good idea to sell my current stock and transfer money only to stocks that are easy to return.

Speaking of fluctuation, isn’t cyclical good?

Some people think so, but personally, cyclical stocks have a long cycle, so I don’t buy them much.

What Small investors Should do?

If you don’t have enough money, what do you do?

For example, if you only have about 3-5 million yen (30~50K USD) for investment, you don’t have enough money to buy during the crash.

When you start buying, it’s better to do it by someone with a certain amount of money, and when you don’t, it’s not too late to buy it after the fall stops and price starts to rise.

For example, in the case of December 2018, the price fell at a terrifying pace, so it takes courage to go on buying stocks.

Especially for people with small funds, many of them might not be able to buy it because they are afraid that it might run out in the middle.

But I think it was not too late to buy it from January 2019. Especially for those who don’t have much money, it is better to limit the buying of stocks to three stocks at most.

Also, the past charts are helpful, so let’s see roughly where the bottom is.

Whether leverage should be applied or not

In the event of a shock, leverage is basically not acceptable.

Because there is a high possibility that the debt will increase.

On the other hand, You can leverage it when the market crashes, but it depends on the stock.

The stocks you should pay special attention to are those with high daily stock price volatility. These kinds of stocks often cannot accept lower prices.

On the other hand, stocks with low daily volatility don’t have high returns but often have low risks. It is better to compare past charts to determine whether stock prices are likely to return or not.

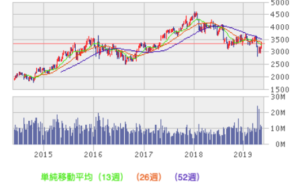

If you look at a chart for about five years, you can see if the prices are higher or lower than the prices at the time of a sharp fall.

For example, let’s take a look at Softbank’s chart for the past five years.

As of December 2019, the stock price had dropped to around 7000 yen, but it has often been higher than this level compared to the past 5 years.

When a rising stock falls sharply, chances are high.

Stocks that I bought at the 2018/19 crash

JR Tokai (9022)

Central Japan Railway Company (9022) is the most powerful railway company in Japan, and as long as people travel there, it can earn stable earnings.

Therefore, even if the economy deteriorates, there is little risk of a fall, and it is easy to recover when the economy plunges.

You can get a double rebound by taking a rebound first and then switching to an economy sensitive stock that’s lagging behind the rebound.

SOFTBANK Group (9984)

The SOFTBANK Group’s capital adequacy ratio is low, but it has overwhelming financial power. Its equity capital is about 8 trillion yen, and if you convert the shares of Alibaba that it owns, it actually has assets of about 25 trillion yen.

Stock prices fluctuate, but they move up and down. With such a large stock, even if it dips temporarily, it is highly likely that it will return to any stock price.

By the way, the SOFTBANK Group’s financial results are very easy to understand, so I think it’s worth a look.

Daiwa House (1925)

In the real estate and construction sector, Daiwa House (1925) also has a hard bottom, and we believe there is still room for growth.

At present, real estate and buildings in urban areas such as Tokyo are becoming saturated, and it is thought that the construction of local cities will become active in the future.

The strength of Daiwa House is the sales force and speed that local companies cannot win.

Local governments are now trying to maintain the vitality of the city by gathering infrastructure in the city center. Japan used to be a car kingdom, but now young people don’t drive, and we are aiming to create a town that can be completed on foot or by bicycle.

The trend is changing so that social infrastructure, such as commercial facilities and hospitals, can be built within walking distance of stations in local cities and people can complete their lives there.

In that case, the construction cost won’t be as much as Tokyo, and it will continue to be about 1 billion yen. As for the local government, there are many orders for construction including maintenance and guarantee, and the burden is a little heavy for the local companies, and there is no place that can accept orders as well as footwork as Daiwa House.

The stock price was temporarily damaged by the scandal of Daiwa House the other day, but the damage to the company scale was small and the stock price recovered immediately.

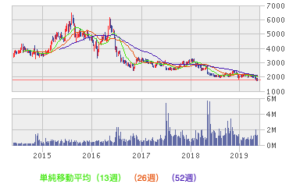

Unizo Holdings (3258)

It’s by far weaker than the stocks I’ve talked about before, but it was the one I decided to buy during the recent sharp decline.

The stock price of Unizo Holdings has been on a declining trend for a long time, but it has finally bottomed out and the trend is finally changing.

This is evidenced by an increase in the number of cases in the past year.

Although earnings are expected to decline, we are still in the black and shareholders’ equity continues to grow.

Moreover, shareholders’ equity is expected to increase further due to the sale of the underlying assets.

a representative of stocks that should not be purchased at the time of a sharp fall

Bank share

First, you should not buy bank stocks in Japan.

In the first place, the management of a bank depends on leverage.

Moreover, the capital adequacy ratio tends to be low.

For example, SMBC has a capital adequacy ratio of about five percent.

These banks could quickly go bankrupt if their total assets were just 10% gone.

Because of this anxiety, there will be non-discount sales, and it is easy to fall to lower prices.

a money-losing company

Companies operating in the red

Of course, companies operating in the red are also dangerous.

One of the most famous brands in Japan is Otsuka Kagu (8186).

These companies can be in the red, and stock prices can drop horribly in a sudden downturn.

Conclusion

The Japanese stock market currently tends to be won by a minority.

This, on the other hand, proves to be a failure of the majority thinking.

This time, I have explained the response to a sharp decline as a minority opinion.

*Invest in stocks at your own discretion. The stocks are not recommended but were bought and sold by me in the past.

Comment Comment